After an accident, one of the first questions most drivers ask is: “How long will my insurance claim take?” Whether you’re navigating a simple fender bender or a major collision in West Hollywood or Hollywood, understanding the process helps set realistic expectations, and keeps things moving.

Average Time to Settle a Collision Claim in California

On average, insurance companies in California settle collision claims within 15 to 45 days. However, this estimate can vary depending on the details of the accident, insurance provider policies, and how quickly you take action.

According to the California Department of Insurance, insurers are required by law to acknowledge receipt of your claim within 15 calendar days. They must also accept or deny the claim within 40 calendar days of receiving proof of loss. While this sets a legal framework, it doesn’t guarantee when you’ll receive your final payment. Delays in inspections, parts delivery, or liability determinations can push timelines well beyond that.

What Affects the Timeline?

Several key factors influence how long it takes for an insurance company to settle a collision claim:

1. Severity of the Damage

If your vehicle only sustained light damage, such as bumper scrapes or a broken mirror, the claim can often be settled quickly, sometimes in under 2 weeks. However, if the accident caused structural damage or affected safety systems like airbags, you’re looking at a much longer process. In these cases, body shops may need special parts or manufacturer approval, adding days or even weeks.

2. Liability Disputes

If both parties involved in the accident disagree on who is at fault, expect delays. Insurance companies will open an investigation which may include reviewing surveillance footage, police reports, witness statements, and physical evidence. If fault is shared or contested, the process can become more complex, especially when dealing with third-party claims.

3. Availability of Parts

Even after the insurance company authorizes repairs, the body shop may face delays waiting for specific parts, particularly if your vehicle uses aluminum, carbon fiber, or manufacturer-specific components. These can be harder to source and take longer to arrive. Vehicles that require custom paint or paintless dent repair may also take more time to schedule and complete.

4. Insurance Adjuster Workload

Delays aren’t always your fault. Insurance adjusters often handle multiple claims at once, especially during times of high volume like storm season or after major events. If your adjuster is slow to respond or review documents, it can add significant time to your claim.

5. Claim Type

If you’re dealing with your own insurer under collision coverage, things usually go faster. But if you file a third-party claim through the other driver’s provider, delays are more likely, especially if they dispute fault or require multiple approvals.

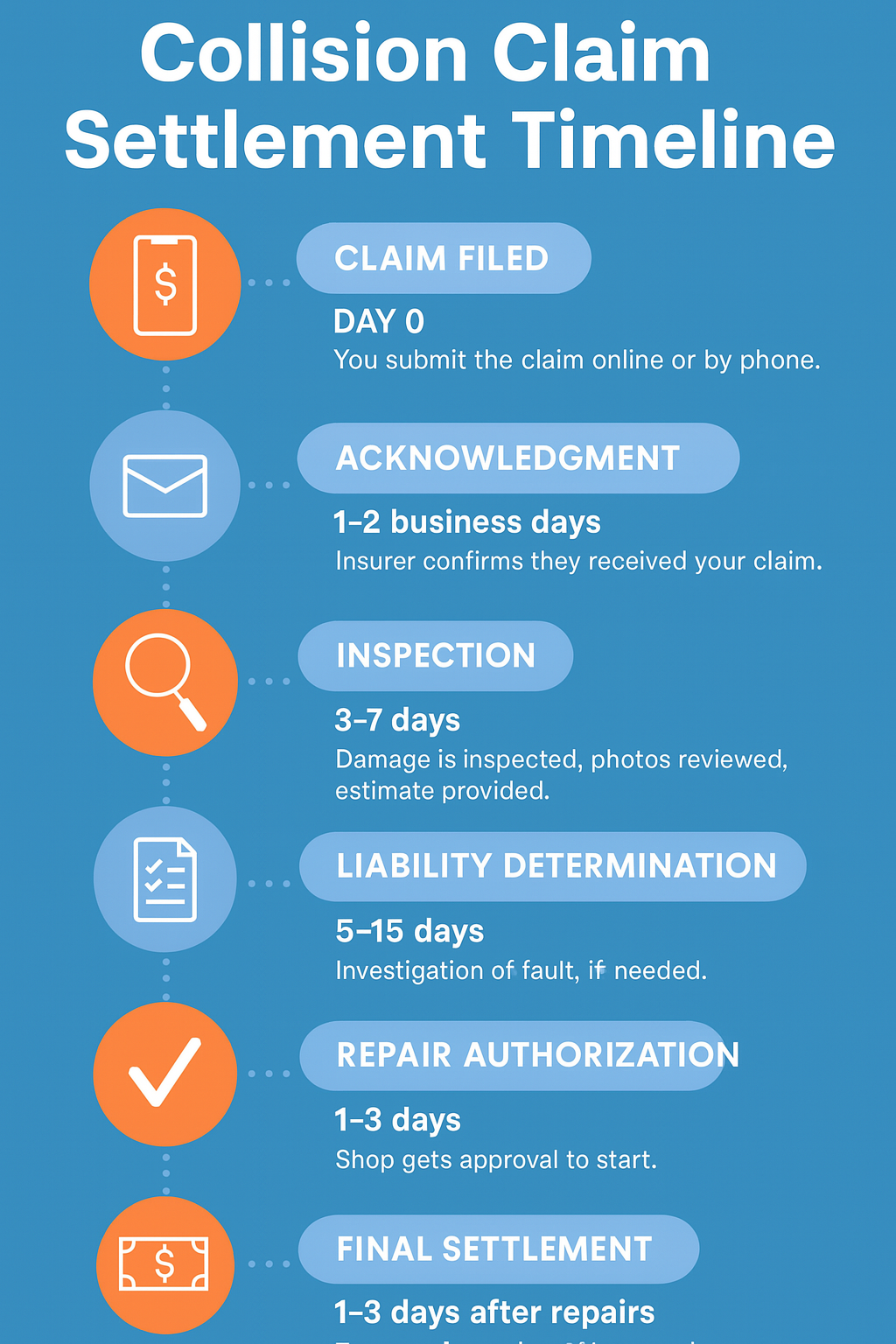

Typical Collision Claim Timeline (Step-by-Step)

How Pristine Collision Center Speeds It Up

We’ve helped dozens of West Hollywood and Hollywood residents get back on the road faster by streamlining everything from inspection to repairs.

Here’s how we help:

- Work directly with all major insurance companies

- Provide fast and accurate damage assessments

- Assist with paperwork and photo documentation

- Offer reliable collision repair, glass replacement, and paintless dent removal

Tip: What You Can Do to Avoid Delays

Here’s what you can do to help your claim move faster:

- Document everything at the scene (photos, police reports, contact info)

- File your claim immediately, ideally within 24–72 hours

- Communicate regularly with your adjuster

- Choose a certified repair center like Pristine Collision Center

- Ask for an estimated timeline and written repair estimate

Why the Right Collision Center Matters

Insurance may cover the cost, but the quality of the repair and timing depends on the shop.

Some body shops cut corners or delay work until parts arrive. At Pristine Collision Center, we specialize in:

We use manufacturer-approved materials and OEM-quality tools to restore your vehicle safely and on time.

FAQs

Insurers must acknowledge a claim within 15 days and accept or deny it within 40 days.

Liability disputes, missing paperwork, or repair shop backlogs are common reasons.

Yes. In California, you’re legally allowed to choose your own collision center.

Start with your own insurance for faster handling, especially with collision coverage.

We work with all major insurers, handle documentation, and provide fast, high-quality repairs.